By Samantha Mou

As a Senior Analyst based in China, Samantha provides support in the Industrial Automation sector. Samantha brings with her a master’s degree in Economics, and gained experience, whilst working in Germany, conducting market research in Industrial Equipment and Automobile Components.

Market revenues for precision gears grew 7.8% year‑over‑year in 2025, following a decline of more than 10% in 2024. This assessment comes from our Precision Gearboxes & Geared Motors report, which draws on extensive surveys with precision gearbox manufacturers.

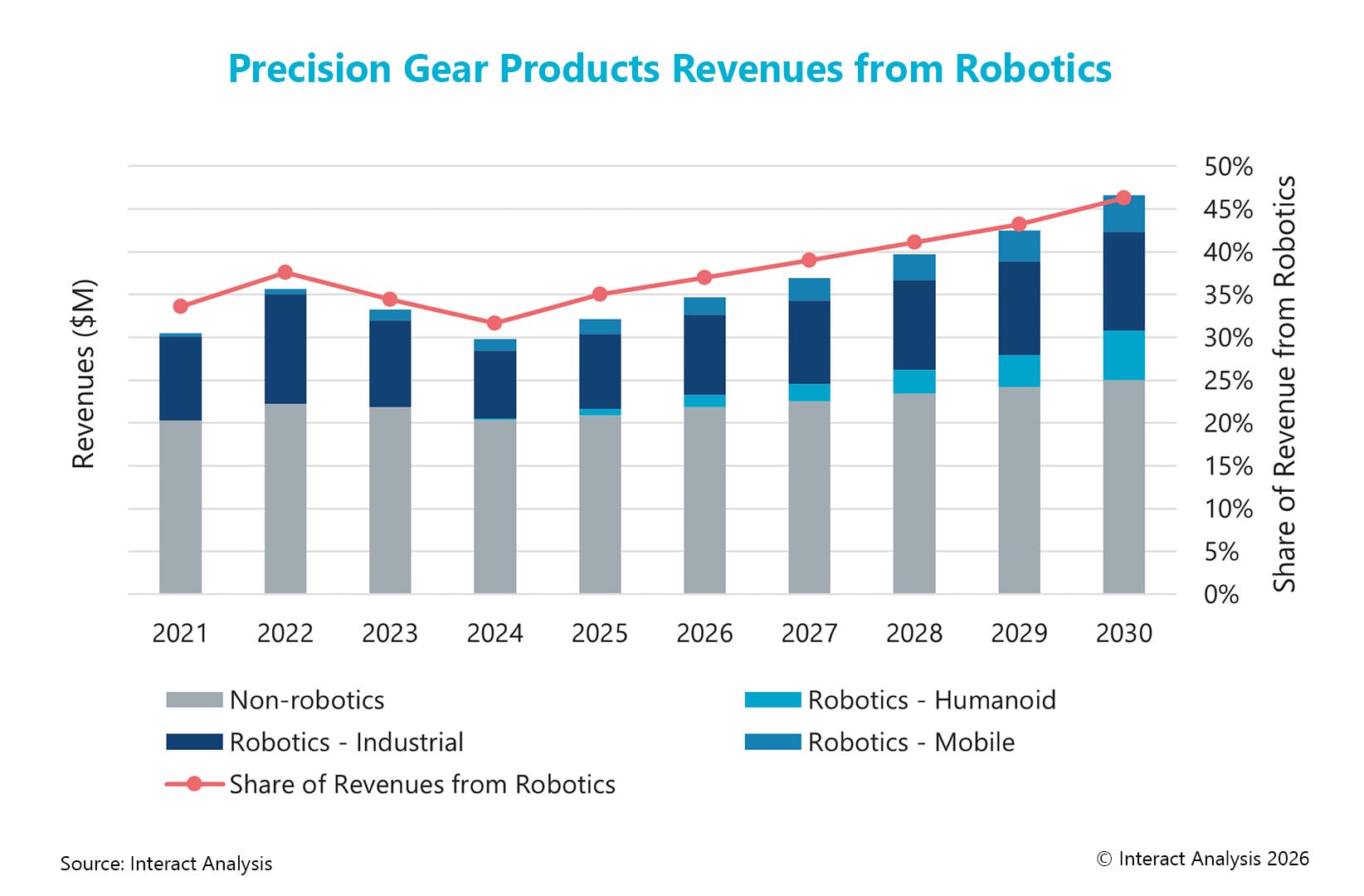

The precision gears market is closely linked to the robotics sector, which contributed 35% of global market revenue in 2025, up from 33.6% in 2021. By 2030, robotics is projected to account for 46.3% of the global precision gear products market. Our latest analysis shows sales of precision gear products across industrial robots, mobile robots, and humanoid robots, and indicates the share of revenues from robotics will increase steadily over the coming years.

Share of precision gear products revenue from robotics is expected to rise

Industrial robots – modest recovery expected in 2026

Revenues from the industrial robots (including collaborative robots) sector accounted for 27.3% of global precision gearbox and geared motor sales in 2025, valued at $878 million. This marks a rebound from $790 million in 2024, although it still falls short of the $1.0 billion recorded in 2023. In 2024, the market contracted significantly, with industrial robot production dropping from over 521,000 units to just over 502,000 units.

The decline for robotics in 2024 was largely due to excess inventories from 2023 and weak investment across major regions. However, in 2025, industrial robot production recovered strongly in Asia, with precision gear product sales growing by 16%, while the market remained largely flat in the Americas and EMEA.

Stronger demand from the industrial robot sector is expected across all major regions in 2026. In the US, reshoring and recovering manufacturing production are driving robotics demand. In Europe, some delayed projects in the automotive sector are expected to resume, while in Asia, steady growth in the electronics and semiconductor industries, fueled by the AI boom, is contributing to a recovery.

Mobile robots – continued growth forecast

The mobile robot sector remains a high-growth and attractive industry, although our shipment forecast has been revised downward for this sector due to economic challenges. Tariffs and uncertainty in 2025 are delaying large-scale investments, prompting a shift toward phased rollouts for deployments.

Despite this, the growth of the mobile robot market remains a key driver of increased sales in precision gear products. Sales of precision gear products to the mobile robot sector grew by 24.5% in 2025, rising to $169 million. With a forecast average annual growth rate of 20.1%, the market is expected to exceed $400 million by 2030, contributing to an 18% of increase in total revenue for the precision gear products market from 2025 to 2030.

Humanoid robots expected to become the second largest precision gear products market by 2030

In 2024, precision gearbox manufacturers generated only $16 million in revenue from humanoid robotics. However, this grew five-fold by the end of 2025, as global humanoid robot production expanded from just under 2,000 units to over 10,000 units. In 2026, revenue from this sector is projected to nearly double again.

Currently, strain wave and planetary gearboxes are predominantly used in the actuators of humanoid robots. Cycloidal gears are only tested and selected for specific models at present, primarily for waist, hip, and knee joints, where higher torque and stiffness are essential. By 2030, strain wave and planetary gears are expected to remain the dominant choice due to their lightweight, compact design, and relatively lower cost. However, cycloidal gears also show promising growth potential for tasks requiring higher torque and greater impact resistance, and they are currently being tested for these applications.

The humanoid robot sector is expected to become the second largest market for precision gear products by 2030

Non-robotics industries

In addition to robotics, precision gearbox sales are expected to see higher revenue annual growth rates by 2030 from sectors such as military & defense, semiconductors & electronics machinery, and medical equipment.

Military and defense production is gaining momentum, fueled by rising defense spending in major regions. Precision gear sales in this sector are expected to grow at an average annual growth rate of 5.9% from 2024 to 2030, outpacing other non-robotics industries. Key applications include positioning and steering systems for radar and communications equipment, aerospace and military aircraft, military vehicles, and unmanned systems.

The semiconductor and electronics industry has seen a cyclical rebound since 2024, fueled by the AI boom and supportive policy initiatives, with investments outpacing other manufacturing industries.

The medical equipment sector, more consumer-facing than traditional industries like machine tools and woodworking, is expected to outperform most general manufacturing sectors in precision gear sales. This is especially the case during recent slowdowns in manufacturing. Similarly, the food and beverage machinery and packaging machinery sectors are projected to sustain relatively higher growth in 2026.

However, while the medical equipment sector typically demands high-end precision gears with reduced backlash, some clients from the food and beverage and packaging industries are opting for “good-enough” products. This has led to lower average prices, dampening revenue growth within these sectors.

Final thoughts

The global precision gearbox and geared motors market saw recovery in 2025 after facing a challenging 2024. Robotics, especially industrial and mobile robots, remains the key driver of future growth, with humanoid robots emerging as a fast-growing sector. However, economic factors like tariffs and investment delays are still affecting short-term sales performance in general manufacturing industries. Looking forward, in addition to robotics, the military and defense, semiconductor machinery, and medical equipment sectors are expected to see promising growth. Driven by the continued trend towards precision automation, the long-term outlook for precision gearboxes remains optimistic.